-

Internal audit

In today's increasingly competitive and regulated market place, organisations - both public and private - must demonstrate that they have adequate controls and safeguards in place. The availability of qualified internal audit resources is a common challenge for many organisations.

-

IFRS

At Grant Thornton, our International Financial Reporting Standards (IFRS) advisers can help you navigate the complexity of financial reporting so you can focus your time and effort on running your business.

-

Audit quality monitoring

Having a robust process of quality control is one of the most effective ways to guarantee we deliver high-quality services to our clients.

-

Global audit technology

We apply our global audit methodology through an integrated set of software tools known as the Voyager suite.

-

Looking for permanent staff

Grant Thornton's executive recruitment is the real executive search and headhunting firms in Thailand.

-

Looking for interim executives

Interim executives are fixed-term-contract employees. Grant Thornton's specialist Executive Recruitment team can help you meet your interim executive needs

-

Looking for permanent or interim job

You may be in another job already but are willing to consider a career move should the right position at the right company become available. Or you may not be working at the moment and would like to hear from us when a relevant job comes up.

-

Practice areas

We provide retained recruitment services to multinational, Thai and Japanese organisations that are looking to fill management positions and senior level roles in Thailand.

-

Submit your resume

Executive recruitment portal

-

Update your resume

Executive recruitment portal

-

Available positions

Available positions for executive recruitment portal

-

General intelligence assessments

The Applied Reasoning Test (ART) is a general intelligence assessment that enables you to assess the level of verbal, numerical reasoning and problem solving capabilities of job candidates in a reliable and job-related manner.

-

Candidate background checks

We provide background checks and employee screening services to help our clients keep their organisation safe and profitable by protecting against the numerous pitfalls caused by unqualified, unethical, dangerous or criminal employees.

-

Capital markets

If you’re buying or selling financial securities, you want corporate finance specialists experienced in international capital markets on your side.

-

Corporate simplification

Corporate simplification

-

Expert witness

Expert witness

-

Family office services

Family office services

-

Financial models

Financial models

-

Forensic Advisory

Investigations

-

Independent business review

Does your company need a health check? Grant Thornton’s expert team can help you get to the heart of your issues to drive sustainable growth.

-

Mergers & acquisitions

Mergers & acquisitions

-

Operational advisory

Grant Thornton’s operational advisory specialists can help you realise your full potential for growth.

-

Raising finance

Raising finance

-

Restructuring & Reorganisation

Grant Thornton can help with financial restructuring and turnaround projects, including managing stakeholders and developing platforms for growth.

-

Risk management

Risk management

-

Technology & Digital Services

Technology Services

-

Transaction advisory

Transaction advisory

-

Valuations

Valuations

-

Human Capital Consulting

From time to time, companies find themselves looking for temporary accounting resources. Often this is because of staff leaving, pressures at month-end and quarter-end, or specific short-term projects the company is undertaking.

-

Strategy & Business Model

Strategy & Business Model

-

Process Optimisation & Finance Transformation

Process Optimisation & Finance Transformation

-

System & Technology

System & Technology

-

Digital Transformation

Digital Transformation

-

International tax

With experts working in more than 130 countries, Grant Thornton can help you navigate complex tax laws across multiple jurisdictions.

-

Licensing and incentives application services

Licensing and incentives application services

-

Transfer pricing

If your company operates in more than one country, transfer pricing affects you. Grant Thornton’s experts can help you manage this complex and critical area.

-

Global mobility services

Employing foreign people in Australia, or sending Australian people offshore, both add complexity to your tax obligations and benefits – and we can guide you through them.

-

Tax compliance and tax due diligence review services

Tax compliance

-

Value-Added Tax

Value-Added Tax

-

Customs and Trade

Customs and Trade

-

Service Line

グラントソントン・タイランド サービスライン

-

Business Process Outsourcing

Companies, large and small, need to focus on core activities. Still, non-core activities are important, and they need to be leaner and more efficient than most companies can make them sustainably. For Grant Thornton, your non-core activities are our core business. Grant Thornton’s experienced outsourcing team helps companies ensure resilience, improve performance, manage costs, and enhance agility in resourcing and skills. Who better to do this than an organisation with 73,000 accountants? At Grant Thornton we recognise that that outsourcing your F&A functions is a strategic decision and an extension of your brand. This means we take your business as seriously as we take our own.

-

Technology and Robotics

We provide practical digital transformation solutions anchored in business issues and opportunities. Our approach is not from technology but from business. We are particularly adept at assessing and implementing fast and iterative digital interventions which can drive high value in low complex environments. Using digital solutions, we help clients create new business value, drive efficiencies in existing processes and prepare for strategic events like mergers. We implement solutions to refresh value and create sustainable change. Our solutions help clients drive better and more insightful decisions through analytics, automate processes and make the most of artificial intelligence and machine learning. Wherever possible we will leverage your existing technologies as our interest is in solving your business problems – not in selling you more software and hardware.

-

Technical Accounting Solutions

The finance function is an essential part of the organisation and chief financial officer (CFO) being the leader has the responsibility to ensure financial discipline, compliance, and internal controls. As the finance function is critical in every phase of a company’s growth, the CFO role also demands attention in defining business strategy, mitigating risks, and mentoring the leadership. We offer technical accounting services to finance leaders to help them navigate complex financial and regulatory environments, such as financial reporting and accounting standards, managing compliance requirements, and event-based accounting such as dissolutions, mergers and acquisitions.

-

Accounting Services

Whether you are a local Thai company or a multinational company with a branch or head office in Thailand you are obliged to keep accounts and arrange for a qualified bookkeeper to keep and prepare accounts in accordance with accounting standards. This can be time consuming and even a little dauting making sure you conform with all the regulatory requirements in Thailand and using Thai language. We offer you complete peace of mind by looking after all your statutory accounting requirements. You will have a single point of contact to work with in our team who will be responsible for your accounts – no matter small or large. We also have one of the largest teams of Xero Certified Advisors in Thailand ensuring your accounts are maintained in a cloud-based system that you have access to too.

-

Staff Augmentation

We offer Staff Augmentation services where our staff, under the direction and supervision of the company’s officers, perform accounting and accounting-related work.

-

Payroll Services

More and more companies are beginning to realize the benefits of outsourcing their noncore activities, and the first to be outsourced is usually the payroll function. Payroll is easy to carve out from the rest of the business since it is usually independent of the other activities or functions within the Accounting Department. At Grant Thornton employees can gain access to their salary information and statutory filings through a specialised App on their phone. This cuts down dramatically on requests to HR for information by the employees and increases employee satisfaction. We also have an optional leave approval app too if required.

-

IBR Optimism of Thailand Mid-Market Leaders Suggests Potential Underestimation of Challenges Ahead: International Business Report, Q1 2024Bangkok, Thailand, April 2024 — The Grant Thornton International Business Report (IBR) for Q1 2024 unveils a strikingly optimistic outlook among Thailand's mid-market business leaders, juxtaposed with the looming challenges that will shape the nation's economic future. With a Business Health Index score of 13.5, Thailand outperforms its ASEAN, Asia-Pacific, and global counterparts, signaling a robust confidence that may overshadow critical issues such as demographic changes, skills shortages, and the necessity for digital advancement.

IBR Optimism of Thailand Mid-Market Leaders Suggests Potential Underestimation of Challenges Ahead: International Business Report, Q1 2024Bangkok, Thailand, April 2024 — The Grant Thornton International Business Report (IBR) for Q1 2024 unveils a strikingly optimistic outlook among Thailand's mid-market business leaders, juxtaposed with the looming challenges that will shape the nation's economic future. With a Business Health Index score of 13.5, Thailand outperforms its ASEAN, Asia-Pacific, and global counterparts, signaling a robust confidence that may overshadow critical issues such as demographic changes, skills shortages, and the necessity for digital advancement. -

Workshop Corporate Strategy and Company Health Check WorkshopThroughout this workshop, we will delve into the life cycle of companies, examining the stages of growth, maturity, and adaptation. Our focus will extend to the current business environment, where your Company stands today, and how our evolving strategy aligns with the ever-changing market dynamics.

Workshop Corporate Strategy and Company Health Check WorkshopThroughout this workshop, we will delve into the life cycle of companies, examining the stages of growth, maturity, and adaptation. Our focus will extend to the current business environment, where your Company stands today, and how our evolving strategy aligns with the ever-changing market dynamics. -

Tax and Legal update 1/2024 Introducing the New “Easy E-Receipt” Tax scheme with up to THB 50,000 in Tax DeductionsThe Revenue Department has introduced the latest tax scheme, the “Easy E-Receipt”, formerly known as “Shop Dee Mee Kuen”. This scheme is designed to offer individuals tax deductions in 2024.

Tax and Legal update 1/2024 Introducing the New “Easy E-Receipt” Tax scheme with up to THB 50,000 in Tax DeductionsThe Revenue Department has introduced the latest tax scheme, the “Easy E-Receipt”, formerly known as “Shop Dee Mee Kuen”. This scheme is designed to offer individuals tax deductions in 2024. -

TAX AND LEGAL Complying with the PDPA – A Balancing ActOrganisations must be aware of the circumstances in which they are allowed to collect data to comply with Thailand’s Personal Data Protection Act.

TAX AND LEGAL Complying with the PDPA – A Balancing ActOrganisations must be aware of the circumstances in which they are allowed to collect data to comply with Thailand’s Personal Data Protection Act.

This is Part 2 of a series on Grant Thornton’s global research for H2 2020. To read Part 1, which introduces the report and provides a framework for interpreting the data, click here.

H2 2020 brought significant improvements in business confidence around the world, according to Grant Thornton’s global research. The change includes a 14% rise in global business confidence over the corresponding H1 2020 totals, alongside double-digit increases in several related categories. Survey respondents from across the business world likewise indicated their intention to increase investment across multiple areas over the next 12 months.

A pair of important caveats are worth highlighting in the context of these findings, however. The first is that the increases represent comparisons only to H1 2020, a historical outlier due to the immediate fallout from the COVID-19 pandemic. All of the aforementioned survey results remain beneath H2 2019 levels. Another element of caution is also warranted when interpreting the research – namely that while the new numbers indicate positive developments over the first half of the year, they also accompany decidedly mixed responses on important business constraints that could limit private sector growth.

Turning the corner – in some areas

Grant Thornton’s global research includes survey responses from more than 10,000 mid-market businesses across 29 economies worldwide. Key statistics from the H2 2020 report include the following:*

- Global business confidence stands at 57% – an increase of 14 ppts from H1 2020 (but a decline of 2% compared to H2 2019).

- Positive revenue expectations stand at 45% – an increase of 11% from H1 2020 (but a decline of 9% compared to H2 2019).

- Positive export expectations stand at 34% – an increase of 9% from H1 2020 (but a decline of 2% compared to H2 2019).

- Positive employment expectations stand at 38% – an increase of 10% from H1 2020 (but a decline of 7% compared to H2 2019).

- Positive profitability expectations stand at 44% – an increase of 12% from H1 2020 (but a decline of 10% compared to H2 2019).

* N.B.: On each question, the questionnaire gives respondents a binary choice, usually asking them to predict an increase or decrease in outcomes over the coming 12 months. Numbers represent the percent of positive responses, after negative responses are subtracted. For example, if 70% of respondents give a positive response to a question, and 30% give a negative response to the same question, the number listed here will be 40%.

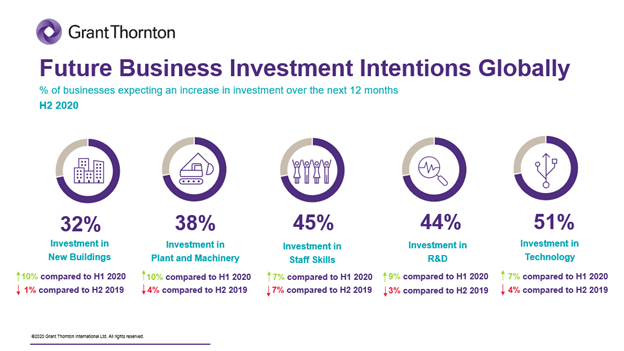

Similar patterns are evident in the data on expected investment over the next 12 months, which likewise represent an increase from H1 2020 estimates. See the chart below for details:

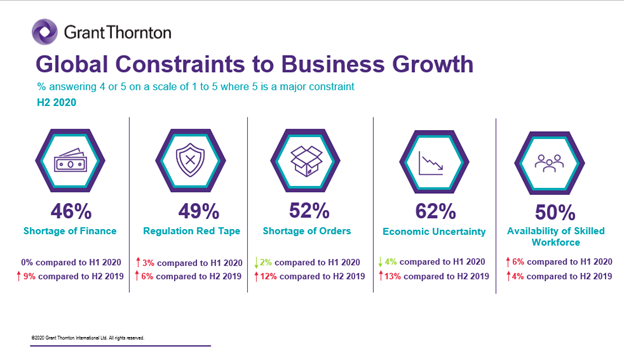

These numbers once again highlight relatively modest levels of optimism – essentially what might be expected from a global economy that is beginning to recover from its lowest ebb. More fascinating is the following data set, which indicates that the major constraints limiting business growth are expected to remain largely in place even as companies prepare for better performance and increased investment. See for yourself in the following data:*

* In the above chart, expected improvements are marked by down-arrows, as we are measuring the impact of business constraints.

Learning to make lemonade

How shall we understand the apparent contradiction in the data? On one hand, businesses worldwide expect to see better outcomes over the next 12 months – but at the same time, they don’t anticipate much overall difference in the challenges they will face.

Analysing these numbers in detail, the most compelling explanation is that their experience during the pandemic has taught companies to do more with less. It’s worth bearing in mind that these survey responses were delivered during one of the most severe periods of the pandemic, and before vaccines had begun to roll out anywhere in the world.

These improved estimates follow a period of increased digitalisation for many businesses, and accelerated movement towards agile business models. As we’ve discussed elsewhere, the embrace of agility helps organisations follow the upper arm of the ‘K’-shaped recovery that many business analysts predict will characterise economic growth in the post-pandemic period.

Other notable adaptations include the rebalancing of investment priorities towards more traditional categories, and the prioritisation of international sales and supply chains ahead of domestic markets. The details vary by region (and by company), but the flexibility to make these types of choices has allowed businesses to – as the saying goes – turn lemons into lemonade.

Part 3 of this series, covering the APAC region, will follow shortly.