In the TP series Part 1 & Part 2: we have highlighted the potential red flags and how to deal with transfer pricing (TP) audit. The main focus of the Thai Revenue Department (TRD) is on intra-group services, which we will cover in this article.

In this article, you will find guidance on how companies can minimise the risks during the TP audit when it comes to issues related to intra-group services, including examples of evidence and supporting documents.

How the TRD select the TP audit target for intra-group services

Taxpayers who are required to file a TP disclosure form must disclose whether they have engaged in intra-group service transactions with related parties. The TRD uses this information as an assessment tool to analyse the level of risk. If the taxpayer reports a significant amount of intra-group service transactions, it is more likely that the taxpayer will be selected as a target for a tax/TP audit.

Key considerations for intra-group service transactions

According to Notification of the Director-General of the Revenue Department on Income Tax (No. 400), clause (9), intra-group service transactions are in line the arm’s length principle if all of the following four (4) conditions are met:

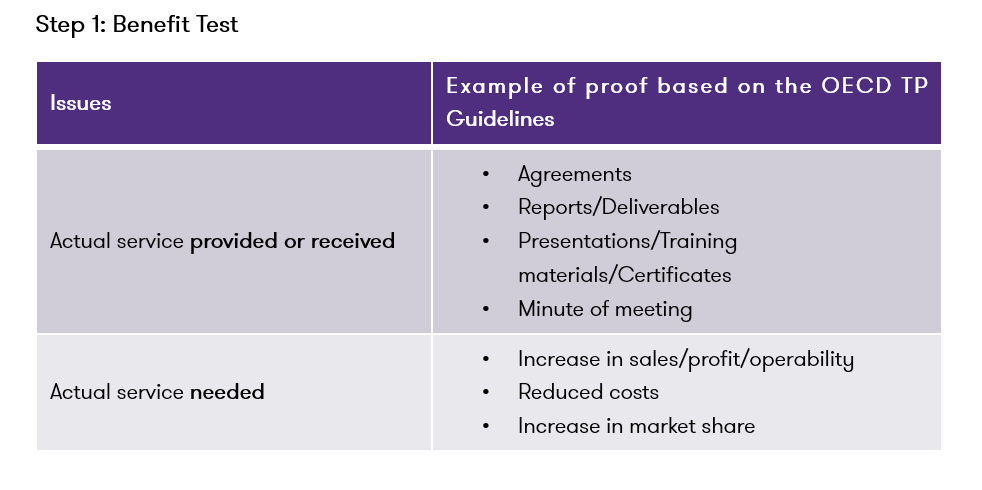

- The service has been actually provided (or received);

- The service has an economic or commercial value for the recipient;

- The service is comparable to the service required by an independent party or internal department—i.e. an independent party is willing to pay for a service; and

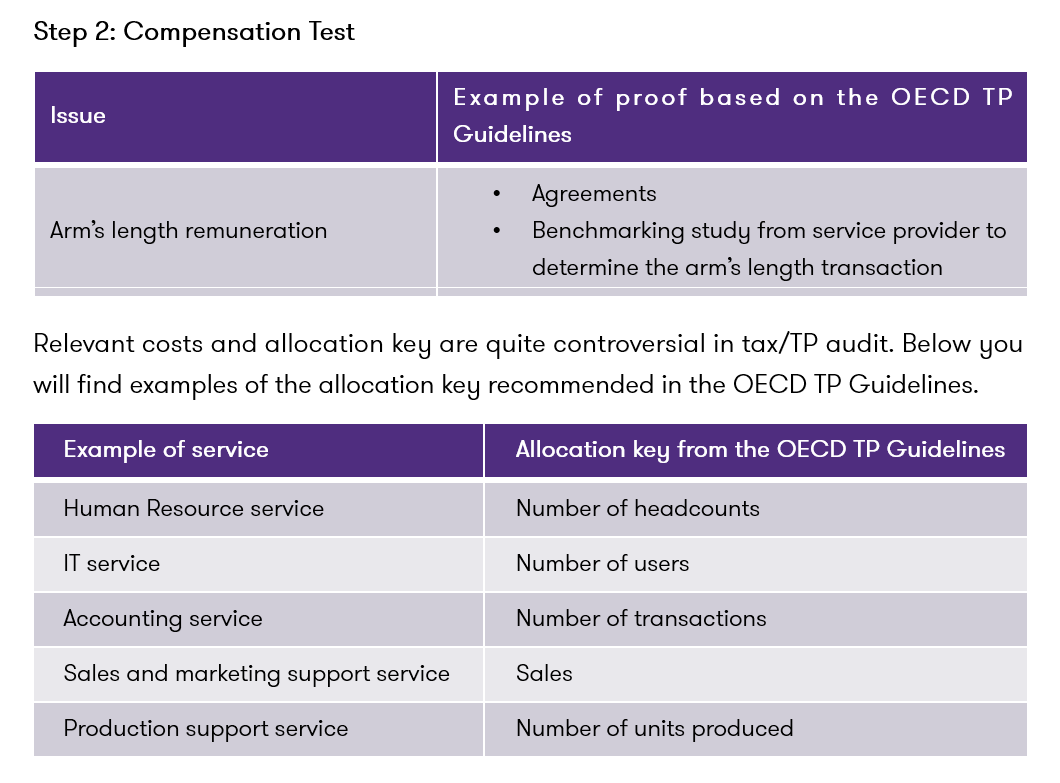

- The amount must be at arm’s length—i.e. it must be consistent with what would be charged between independent parties.

Note: Service fee that benefits shareholders are not considered to be arm’s length remuneration.

From the above conditions, we identify two (2) important steps for verification of intra-group service transactions:

Last but not least, the evidence and documents from step 1 and 2 should be retained to demonstrate the appropriateness of intra-group services and keep available in the event of a tax/TP audit. If not properly justified, the company would face adjustments to revenue or expenses proposed by the TRD during tax/TP audit. The company could face additional taxes and possible surcharges/penalties.

Look to the future: TP issues for royalty transactions

In September 2025, we will publish Transfer Pricing Series Part 4, which will focus on the TP issues for royalty transactions—another area frequently scrutinised in TP audits. Stay tuned to learn more about common issues and best practises for TP management in these specific areas.

For further questions, please contact:

Narumol Limprasert – Tax and Transfer Pricing Partner at Narumol.Limprasert@th.gt.com or +66 2 205 8222

Phatsawut Fueangwutthiron – Transfer Pricing Manager at Phatsawut.fueangwutthiron@th.gt.com or +66 2 205 8273