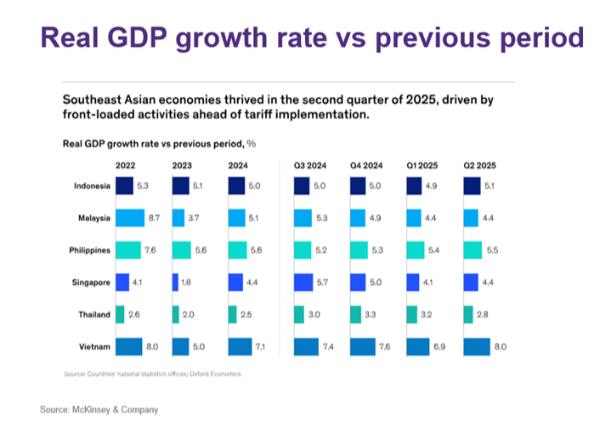

Thailand’s economy expanded by 2.8% in Q2 2025, down from 3.2% in Q1, while most neighbouring economies accelerated. Vietnam led the region with 8.0% growth, followed by modest gains across Indonesia, the Philippines, and Singapore, while Malaysia’s growth rate held steady. The contrast underscores Thailand’s slower pace of reform and its dependence on traditional sectors such as tourism and low-value manufacturing.

Confidence remains fragile

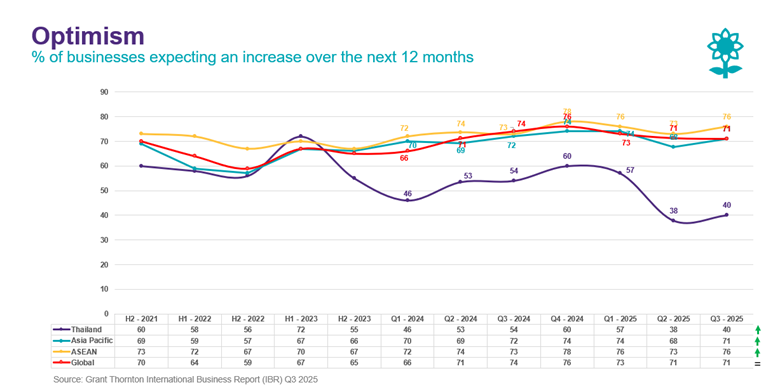

The Q3 IBR shows that 40% of business leaders in Thailand are optimistic about the next 12 months – slightly higher than Q2, but still well below ASEAN (76%), Asia-Pacific (71%), and global (71%) benchmarks. This gap reflects persistent structural challenges, policy uncertainty, and the lingering effects of weak private consumption.

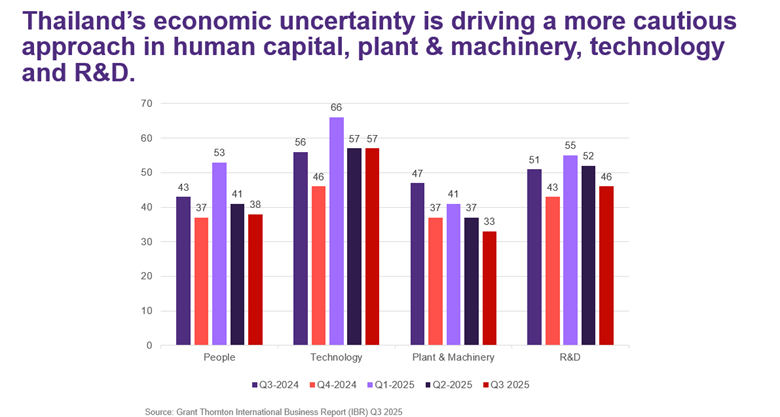

When examining investment intentions, it is clear that businesses in Thailand are not yet confident enough to invest for the future and appear focused on short-term gains. This lack of investment would indicate that they are holding onto cash and waiting to see what is happening with the economy first.

Only 38% of Thai firms plan to increase spending on people (ASEAN 50%, Global 59%), 57% intend to increase investment in technology (ASEAN 70%, Global 68%), 33% in plant and machinery (ASEAN 50%, Global 52%), and 46% in R&D (ASEAN 58%, Global 60%).

This caution suggests that businesses are holding onto liquidity while waiting for clearer economic direction. The continued lack of long-term investment poses a risk to productivity, innovation, and competitiveness – widening the gap with faster-moving ASEAN peers.

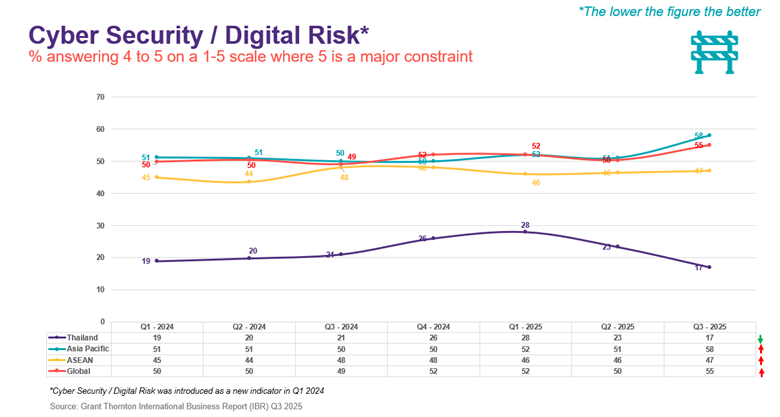

Cybersecurity: a growing blind spot

One area of concern highlighted in the report is a lack of awareness of the risks of cybersecurity where Thailand continues to underrate the risk compared to the comparator groups.

This is at odds with the recent press coverage claiming that cyber attacks in Thailand are 70% higher than the global average and the Government introducing new legislation for the Prevention and Suppression of Technological Crimes.

Ian Pascoe, CEO and Managing Partner at Grant Thornton in Thailand, commented: “The latest IBR data shows that while sentiment has stabilised slightly, investment confidence remains weak. Businesses in Thailand are holding back on the very steps – in people, technology, and innovation – that would strengthen long-term competitiveness. The challenge now is to move from caution to capability.”

Looking ahead

The global backdrop remains uncertain. U.S. tariff negotiations, geopolitical disruption, and domestic political volatility continue to weigh on sentiment. Persistent household and corporate debt levels, coupled with slow AI adoption and weak productivity growth, leave the economy vulnerable to external shocks.

While government stimulus measures and tourism incentives offer short-term relief, Thailand’s long-term outlook will depend on structural reform and renewed private-sector investment. For now, mid-market businesses remain resilient but cautious – hopeful about their own performance, yet hesitant to make the investments needed for sustainable growth.

About the IBR

The Grant Thornton International Business Report (IBR) is the world’s leading mid-market business survey. Launched in 1992, it provides insight into the views and expectations of more than 4,000 business leaders across 35 economies.

The Q3 2025 Thailand findings are based on interviews with 90 mid-market executives conducted between 14 July and 2 September 2025 and analysed in partnership with Oxford Economics.

For more information, please contact:

Rattanakorn (KJ) Sutthiphongkait

Marketing Communications and Branding Manager

Marketing Communications & Business Development (MCBD)

+66 2 205 8222 ext. 8144

marketing@th.gt.com