Bangkok, Thailand, April 2025 - The latest Grant Thornton International Business Report (IBR) for Q1 2025 reveals that although Thai mid-market business leaders remain broadly confident, they are cautious about certain growth areas when compared to ASEAN, Asia-Pacific, and global counterparts.

For context, Thailand’s real GDP expanded by 3.2% in Q4 2024, driven by a 10.6% increase in exports and strong capital inflows. Inflation stayed low at 1.0%, prompting the Bank of Thailand to adopt an easing stance by lowering its policy rate to 2.0% as of February 2025.

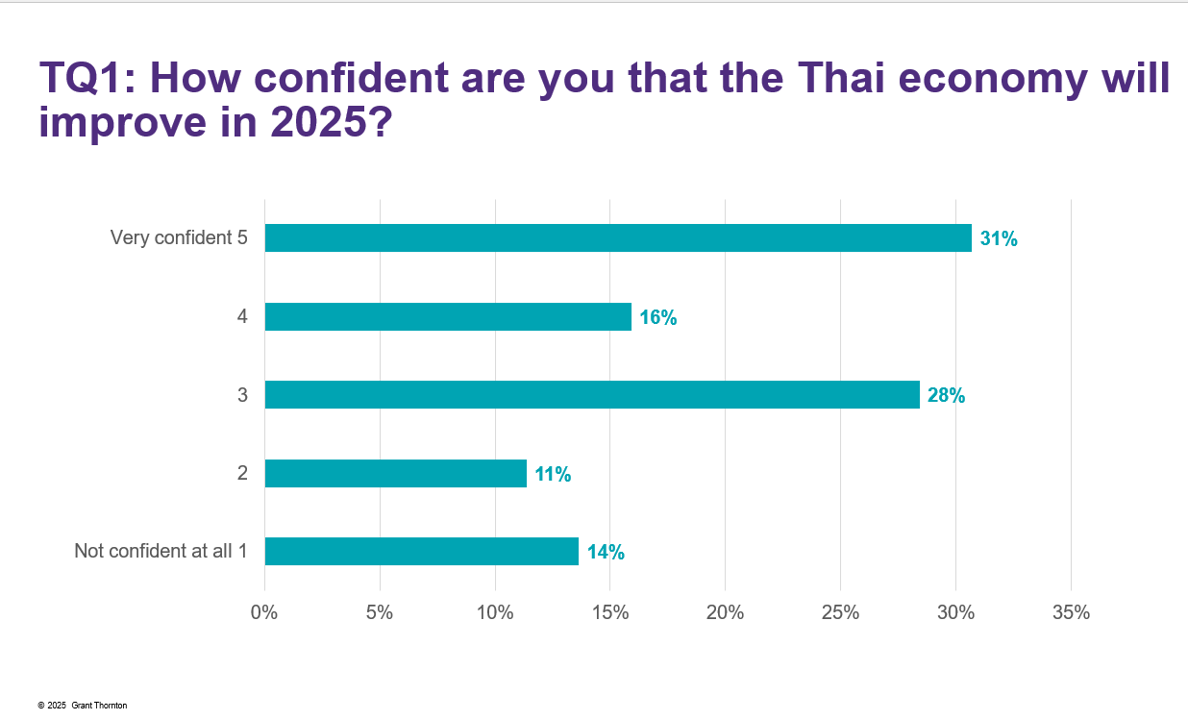

Against this backdrop, Thai mid-market sentiment remained remarkably optimistic, with 31% of respondents reporting they were "very confident" about economic improvement in 2025.

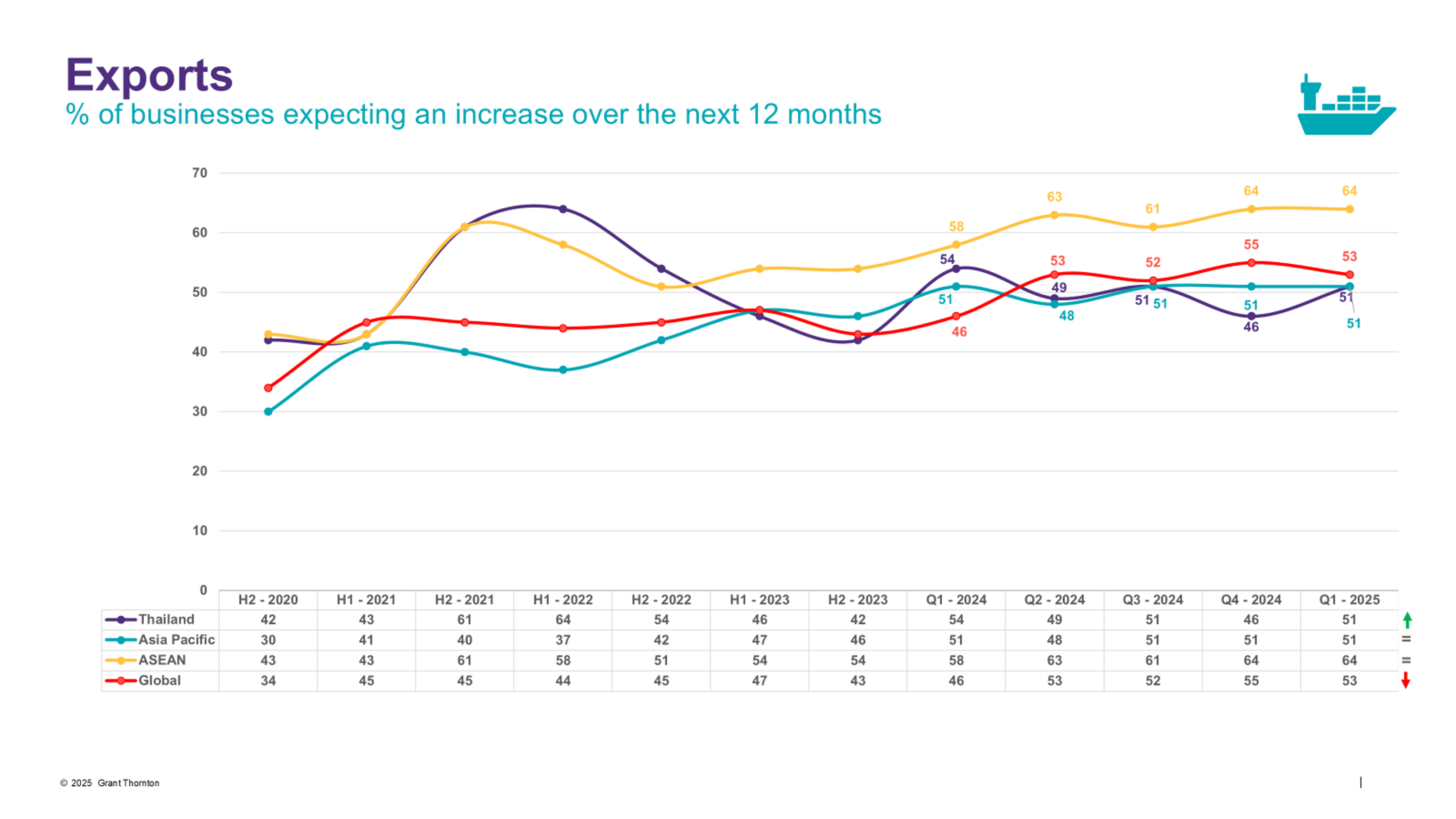

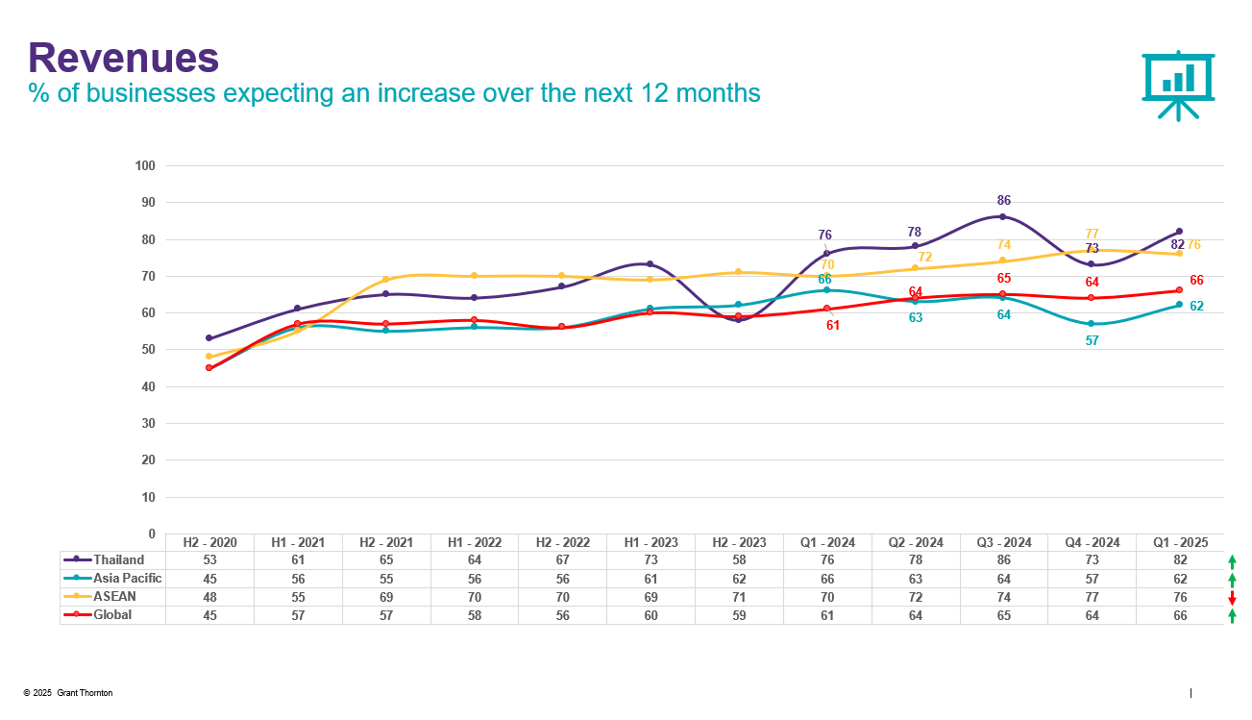

However, expectations around exports, revenues, and profitability show mixed results compared to regional and global peers:

- Exports: Only 51% of Thai businesses expect export growth, significantly behind ASEAN (64%) and slightly below global (53%) expectations, though on par with the Asia-Pacific average (51%).

- Revenue growth: Thai businesses show stronger optimism here, with 82% anticipating growth, higher than ASEAN (76%), and substantially above Asia-Pacific (62%) and global (66%) averages.

Profitability expectations: Thai businesses are notably more positive, with 85% expecting increased profitability, comfortably surpassing ASEAN (76%), Asia-Pacific (59%), and global peers (63%).

Investment Intentions and Emerging Constraints

Investment intentions among Thai businesses remain relatively strong but highlight some areas of concern:

- Technology investment: 66% of Thai businesses plan increases, yet this trails behind ASEAN peers (75%) and is marginally below the global average (68%), although ahead of the Asia-Pacific region (59%).

- Workforce investment: Despite jumping up from 37% to 53% since the last report, Thailand slightly lags ASEAN (55%) and is clearly behind Asia-Pacific (58%) and global averages (62%).

- R&D investment: 55% of Thai businesses intend to increase spending, which is significantly behind ASEAN (68%) and somewhat behind global (58%), though slightly ahead of Asia-Pacific (54%).

Despite these intentions, emerging constraints remain evident. Economic uncertainty was cited by 50% of Thai respondents as a major concern – down slightly from 52% in the previous quarter – and comparable to regional and global figures (ASEAN 54%, Asia-Pacific 56%, Global 55%).

Additionally, cybersecurity and digital risk awareness remains alarmingly low, with only 28% of Thai businesses identifying these as major concerns compared to 52% globally. Ian Pascoe, CEO & Managing Partner at Grant Thornton in Thailand, commented: "Thai businesses were surprisingly optimistic in Q1 2025, but the global environment has changed dramatically since then. Confidence is not enough – companies must now invest wisely, prepare for greater external shocks, and tackle persistent structural challenges such as digital vulnerability and talent development. Otherwise, Thailand risks falling behind just as competition across ASEAN intensifies."

Rising Global and Domestic Pressures: Several new risks now shape the economic outlook for 2025:

- Recently imposed U.S. tariffs are likely to disproportionately impact Thai exports, given their relatively high exposure to the U.S. market.

- Persistent high levels of household debt continue to constrain domestic consumption.

- Concerns over commercial debt quality raise additional questions regarding long-term financial stability.

- Ongoing political instability and tightening bank lending practices pose further investment barriers.

The IBR data underscores that while Thai mid-market businesses entered 2025 in a comparatively strong position, their real test will be adapting effectively to an increasingly volatile global business landscape.

About the IBR

The Grant Thornton International Business Report (IBR) has tracked mid-market sentiment worldwide since 1992. The Q1 2025 research is based on interviews with 88 mid-market business leaders in Thailand, conducted from 27 January to 3 March 2025. Data analysis was carried out in partnership with Oxford Economics.

For more information, please contact:

Rattanakorn Sutthiphongkait

Marketing Communications and Branding Manager

Marketing Communications & Business Development (MCBD)

T: +66 2 205 8222 ext. 8144

Email: marketing@th.gt.com

Download a copy of Grant Thornton IBR Q1 2025

Please click the link to download Grant Thornton International Business Report (IBR) – Q1 2025 if it is not downloaded automatically.