This tax news will be of interest to: Thai companies that are part of multinational enterprise (MNE) groups and engage in intercompany transactions. In our Part 3: we have provided guidance on how companies can minimise risks during a tax/TP audit related to intra-group services, as well as examples of evidence and supporting documents. In this article, you will find guidance on how to minimise risk related to royalty transaction.

How the TRD select the TP audit target for the royalty transaction

Taxpayers required to file a TP disclosure form must disclose whether they have paid royalties with related parties. The TRD uses this information as an assessment tool to analyse the level of risk. If the taxpayer reports a significant amount of royalty transactions, it is more likely that the taxpayer will be targeted for a tax/TP audit.

Key considerations for the royalty transaction

According to Notification of the Director-General of the Revenue Department on Income Tax (No. 400), clause (10), royalty transactions are in line with the arm’s length principle if the following two (2) conditions are taken into the consideration:

1) There is an involvement of related parties in the development, enhancement, maintenance, protection and exploitation (DEMPE) functions; and

2) When granting the right to use, sell or transfer intellectual property (IP), there should be an expected benefit, geographic limitation, uniqueness of the IP and the right to participate in the development of the IP.

The above conditions result in three (3) important steps for verification.

Step 1: Function Test

If the company is the fee payer, it must prove that it does not perform any development, enhancement, maintenance, protection and exploitation (DEMPE) functions. On the other hand, if the company is the owner of the IP that grants the right to use the IP, the company must demonstrate that it performs DEMPE functions. To support the analysis, an analysis of the functions performed, assets used and risks assumed (FAR) should be conducted to clearly demonstrate the roles and responsibilities of each party involved.

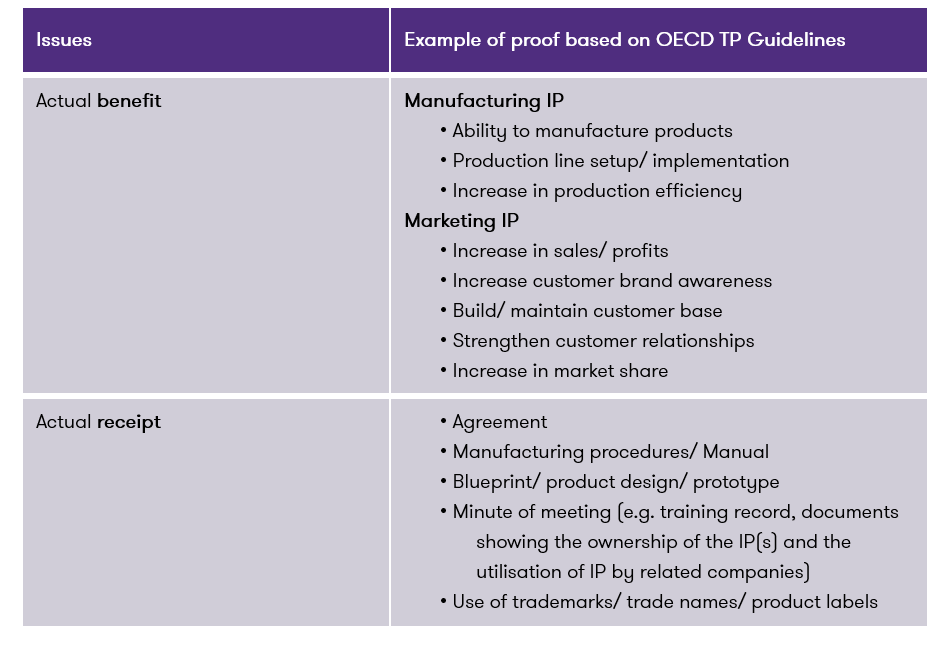

Step 2: Benefit Test

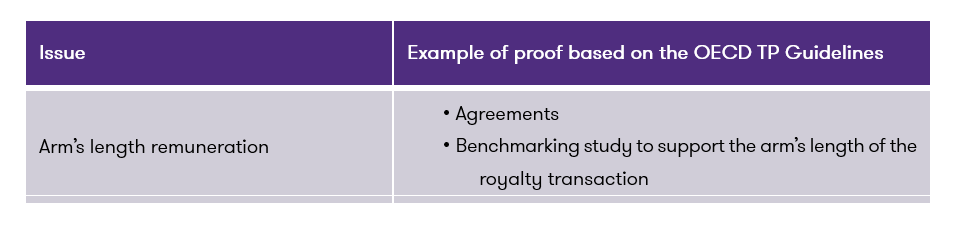

Step 3: Compensation Test

Regarding the benchmarking study, the Comparable Uncontrolled Transaction (CUT) method is generally the preferred method to evaluate the arm’s length rate of the royalties. Since there is no public royalty database in Thailand, taxpayers may use an international royalty database to conduct a CUT benchmarking study. Alternatively, the Transactional Net Margin Method (TNMM) may be applied if the royalties are closely linked to the company’s business operations.

Last but not least, the supporting evidence and documentation from step 1 to 3 should be retained to demonstrate the reasonableness of the royalty transaction and keep available in the event of a tax/TP audit. If not properly justified, the company would face adjustments to expenses proposed by the TRD during tax/TP audit. The company could face additional taxes and possible surcharges/penalties.

As we approach the end of the year, we have prepared special tips for you in the Transfer Pricing Series Part 5, which will be published in November 2025. This part will focus on practical tools for managing transfer pricing risks.

Gain valuable insights and prepare your best transfer pricing practices for the coming year. Don’t miss it!