Bangkok, Thailand, July 2025 – Business confidence among Thailand’s mid-market firms continued to decline in Q2 2025, with reduced expectations across revenue, exports, and employment – despite solid GDP growth and an impressive export performance in the first quarter. The second half of the year is going to be much more challenging with GDP growth continuing to fall.

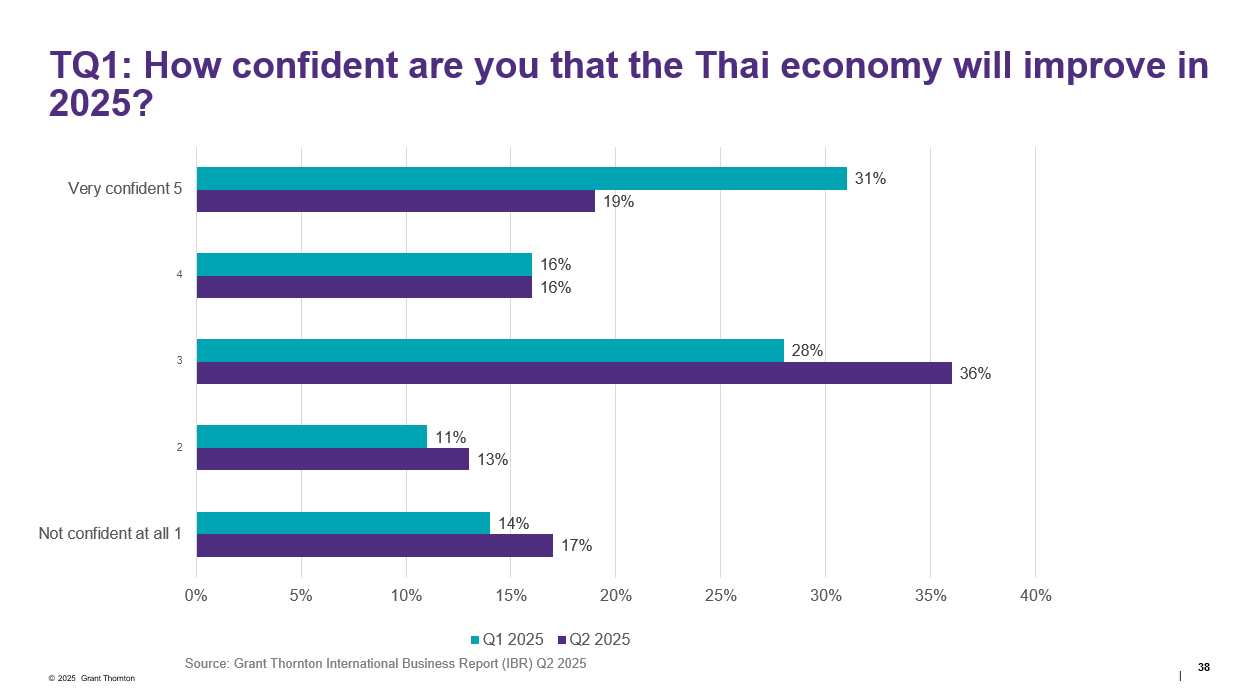

According to the latest Grant Thornton International Business Report (IBR), conducted between 16 April and 29 June 2025, Thai mid-market businesses are navigating a more uncertain economic landscape. The percentage of leaders “very confident” in economic improvement dropped sharply to 19%, down from 31% in Q1. A plurality of respondents (36%) are now “unsure,” while 17% report having no confidence at all.

This cautious sentiment comes despite Thailand’s 3.1%

GDP growth in Q1 2025, underpinned by 15.0% export growth and a 26.3% rise in public investment. Compared to neighbouring Southeast Asian economies – many of which also experienced slower growth due to trade tensions – Thailand’s Q1 export rebound was a regional standout. However, softening private consumption, declining PMI (Purchasing Managers Index) levels, and mounting geopolitical risks have tempered future expectations.

Ian Pascoe, CEO and Managing Partner at Grant Thornton in Thailand, commented: “This quarter’s data highlights an increasingly cautious business community. Thai firms continue to report strong expectations for profitability and revenue, but their reluctance to invest in people, technology, and R&D suggests a mismatch between ambitions and actions. Confidence is a good starting point, but execution is what counts – especially in a region where competition is intensifying and structural challenges persist.”

Business Expectations Continue to Slide

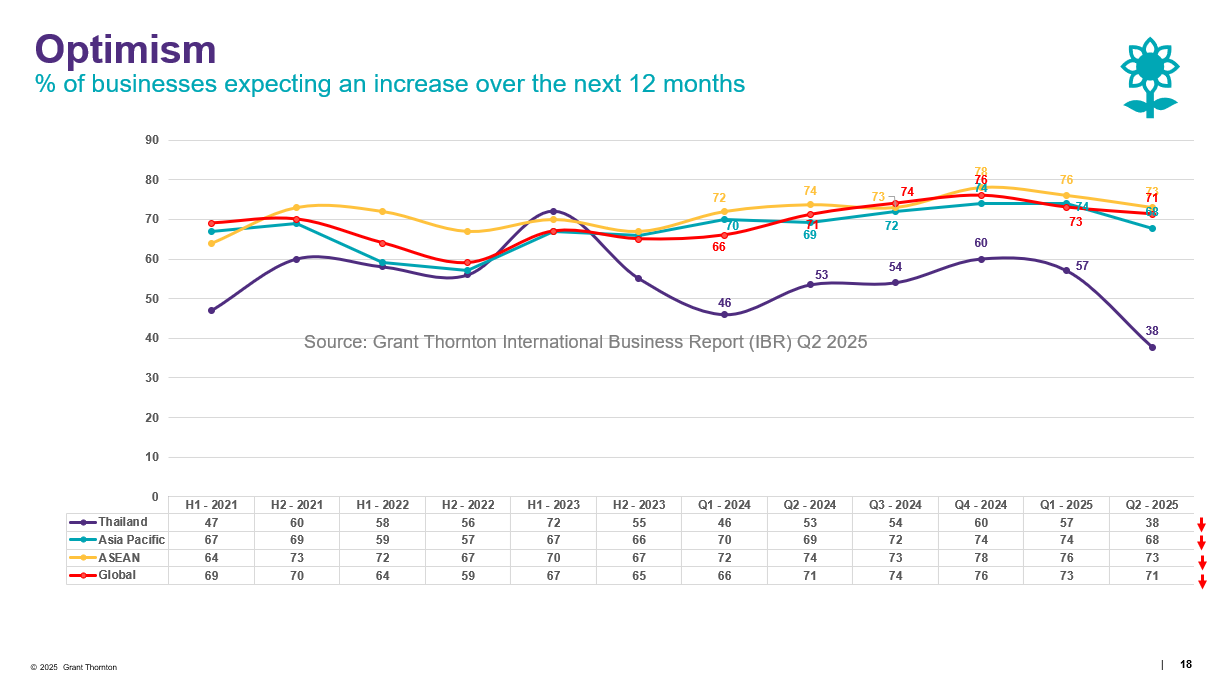

Only 38% of Thai businesses expect the economy to improve over the next 12 months, down from 57% in Q1. This is far below sentiment in ASEAN (73%), Asia Pacific (68%), and global (71%) peers. The trend reflects growing domestic and international pressures, including political uncertainty, rising trade tensions, and concerns over debt and regulatory complexity.

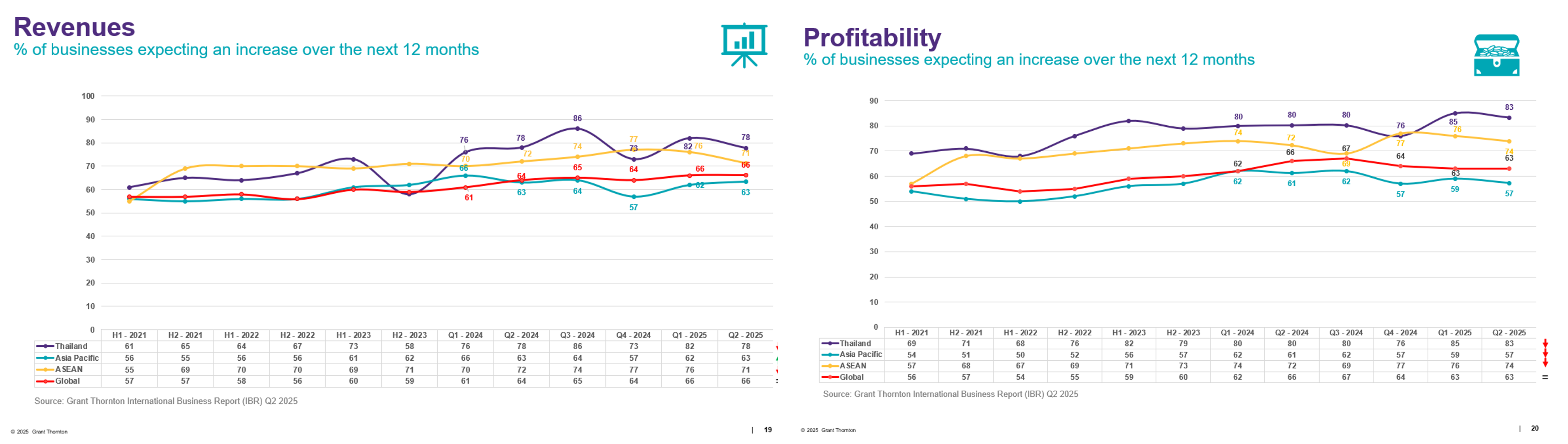

Even as economic confidence softens, Thai businesses continue to report high expectations for their own performance. 78% expect revenue growth in the year ahead – well above ASEAN (71%), Asia-Pacific (63%), and global (66%) averages. Profitability forecasts are even stronger, with 83% of respondents expecting gains, compared to 74% across ASEAN, 57% in Asia-Pacific, and 63% globally.

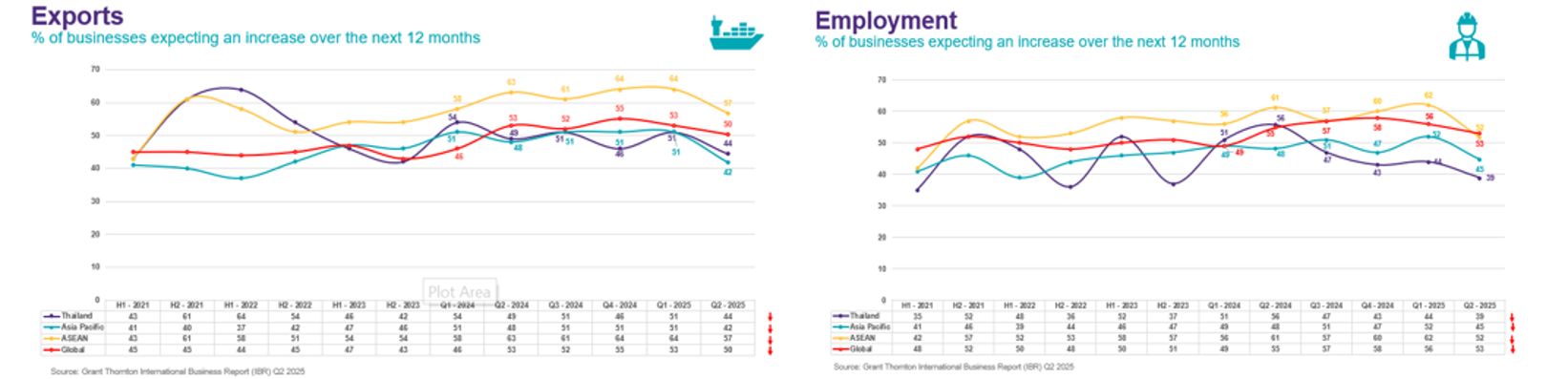

However, this self-assurance is not mirrored in other areas and is possibly more hope than reality. Only 44% of Thai firms expect export growth – down from 51% in Q1 and now below both ASEAN (57%) and global (50%) expectations. Employment growth projections have also weakened, falling to 39% in Q2, significantly behind ASEAN (52%) and global peers (52%).

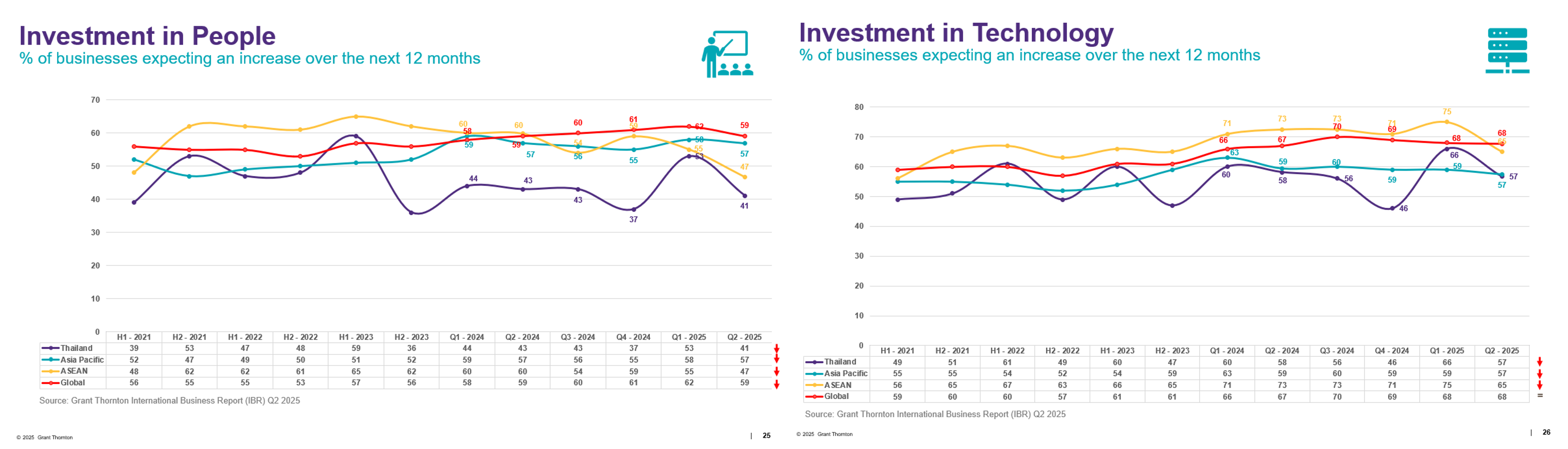

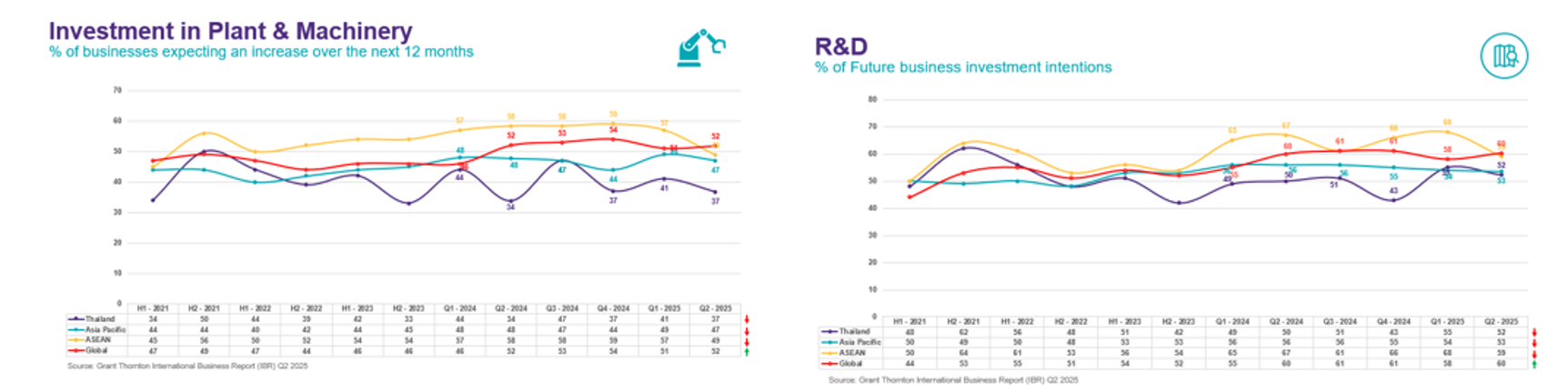

Investment Intentions Reveal a Growing Caution

By way of further caution, Thai businesses are also pulling back on investment.

Planned investment in people dropped sharply to 41%, from 53% in the previous quarter. This puts Thailand behind ASEAN (47%), Asia-Pacific (57%), and global (59%) benchmarks. Intentions to invest in technology also declined, down to 57% from 66% in Q1. This figure now matches Asia-Pacific, but lags ASEAN (66%) and global peers (68%).

Other critical growth areas are showing similar retrenchment. Just 37% of Thai firms plan to increase investment in plant and machinery, well below the global average of 52%. Meanwhile, R&D investment intentions fell slightly to 52%, trailing ASEAN (59%) and global peers (60%).

The disparity between expected financial performance and declining investment suggests that many businesses remain hopeful for positive outcomes — but are not yet willing to commit the resources needed to secure them.

Looking Ahead: Challenges That Demand Action

As Thai business leaders weigh their next moves, several structural and external risks loom large. Continued US tariff negotiations, domestic political instability, and the ongoing Cambodian border dispute have all contributed to an increasingly volatile business environment. At the same time, long-term issues such as low productivity, an ageing population, high household debt, concerns over the quality of corporate debt, and Thailand’s low standing on the Corruption Perceptions Index continue to pose serious challenges.

Confidence in the Thai baht remains relatively firm, supported by significant capital inflows in early 2025. Many would like to see a weaker Baht to aid exports, support growth in tourism and boost the economy. However, investor sentiment overall is expected to remain fragile and decline unless greater clarity emerges both domestically and internationally.

About the IBR

The Grant Thornton International Business Report (IBR) is the world’s leading mid-market business survey. Launched in 1992, the IBR provides insight into the views and expectations of more than 4,000 business leaders in 35 economies. The Q2 2025 Thailand findings are based on interviews with 90 mid-market executives and analysed in partnership with Oxford Economics.

For more information, please contact:

Rattanakorn Sutthiphongkait

Marketing Communications and Branding Manager

Marketing Communications & Business Development (MCBD)

📞 +66 2 205 8222 ext. 8144

📧 marketing@th.gt.com