This tax news will be of interest to: Thai companies that are part of multinational enterprise (MNE) groups and engage in intercompany transactions.

Introduction

The Thai Revenue Department (TRD) has implemented an artificial intelligence (AI)–driven big data analysis system to improve operational efficiency, review taxpayers’ data, and assess potential risk areas or red flags. The system classifies taxpayers as either “good” or “risky”. If potential red flags are detected, the system notifies the TRD to consider initiating a tax audit. You may refer to our transfer pricing (TP) series Part 1: Potential Red Flags.

In addition, the TRD has recently launched the QUICK BIG WIN scheme, which allows eligible taxpayers to receive tax refunds within a significantly shortened timeframe and without undergoing a tax audit if they meet the scheme’s criteria. This aims to enhance taxpayer liquidity and support business operations.

The company should proactively prepare yourself as a “good taxpayer” by complying with Thai tax laws. This would reduce administrative burdens and costs, and increase the chance of meeting the scheme’s criteria for receiving tax refunds on a fast-track basis.

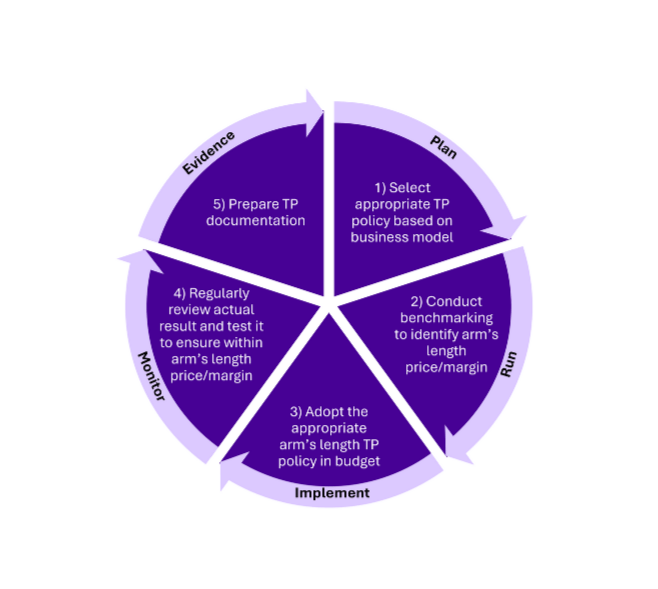

Our TP Best Practice Tools: The PRIME Method

To help businesses strengthen their transfer pricing (TP) position and enhance their readiness for the TRD’s evolving compliance landscape, we present our PRIME TP Best Practice Tools. This framework is easy to remember, practical to apply, and aligned with Thai TP compliance expectations.

P – Plan

Companies should establish an appropriate TP policy based on their business model. Planning involves selecting the most suitable TP approach and ensuring that all relevant TP considerations are integrated into the business’s strategic and operational planning.

R – Run

Companies should conduct benchmarking studies to identify the arm’s length price or margin. Furthermore, companies should run simulations and forecast operating results to test projected outcomes against the arm’s length standard. This step helps support budget accuracy and year-end readiness.

I – Implement

Once the TP policy is finalised, companies should implement it in the budgeting process and operational practices. Implementing the arm’s length TP model in day-to-day operations ensures consistent compliance and reduces year-end adjustments.

M – Monitor

Companies should regularly monitor actual financial results and test them against the arm’s length range. Ongoing monitoring enables timely corrections, minimises deviations, and demonstrates strong TP governance.

E – Evidence

Companies should maintain proper evidence, including good-quality TP documentation such as the TP Local File, TP Disclosure Form, and supporting documents highlighted in our TP Series 1–4. Clear documentation demonstrates the company’s commitment to compliance and supports audit defence.

Conclusion

We hope the PRIME TP Best Practice Tools will help your company establish robust TP governance, mitigate TP risks, and meet the TRD’s criteria. Adopting this approach can reduce both monetary and administrative burdens and promote greater confidence in your TP position.

We wish you a prosperous new year—and with PRIME, a year with fewer TP concerns. We look forward to seeing you next year.

For further questions, please contact:

- Narumol Limprasert – Tax and Transfer Pricing Partner at Narumol.Limprasert@th.gt.com or +66 2 205 8222

- Phatsawut Fueangwutthiron – Transfer Pricing Manager at Phatsawut.fueangwutthiron@th.gt.com or +66 2 205 8273